We Are Increasing Business Success by providing Technology Solutions through:

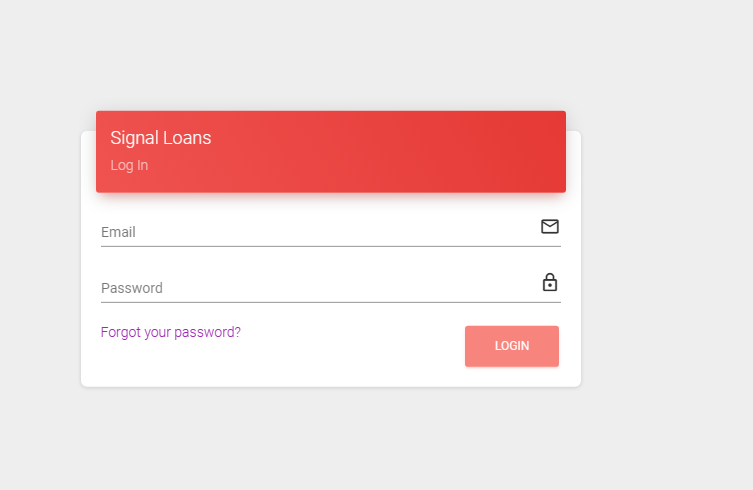

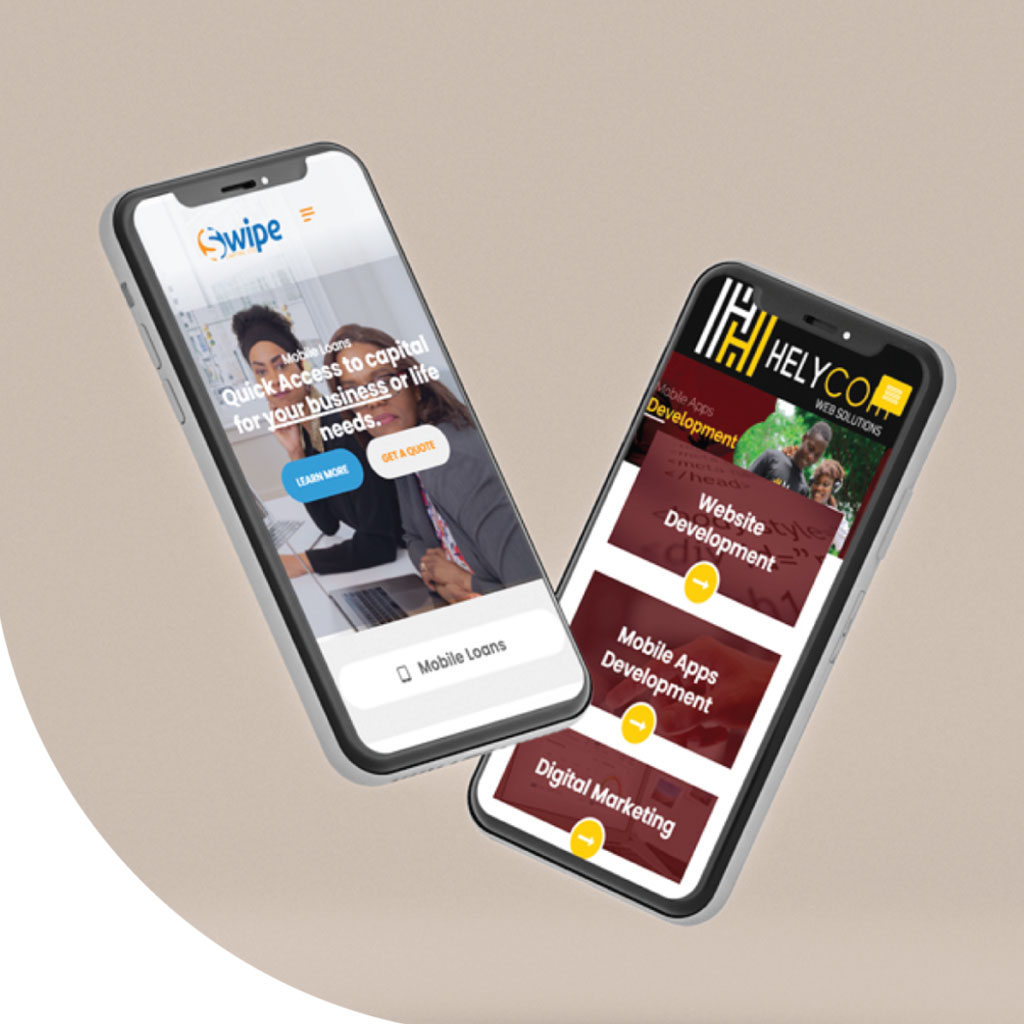

Mobile Application Development

Turn your idea into an app, fast. We build what you need on time and within the budget. Whether you are an aspiring startup or an established brand, you can rely on us.

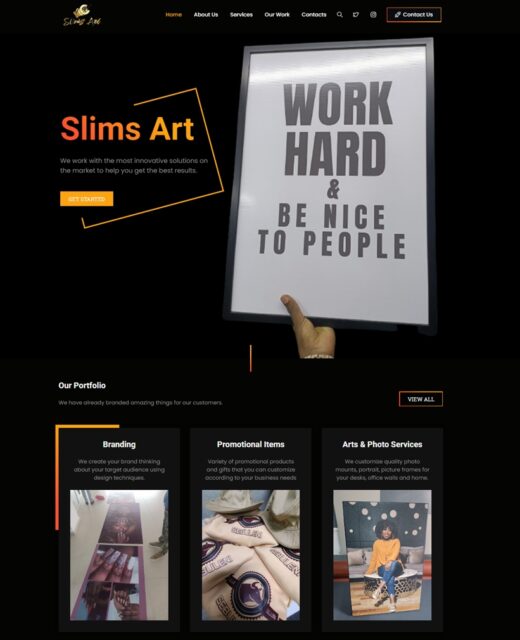

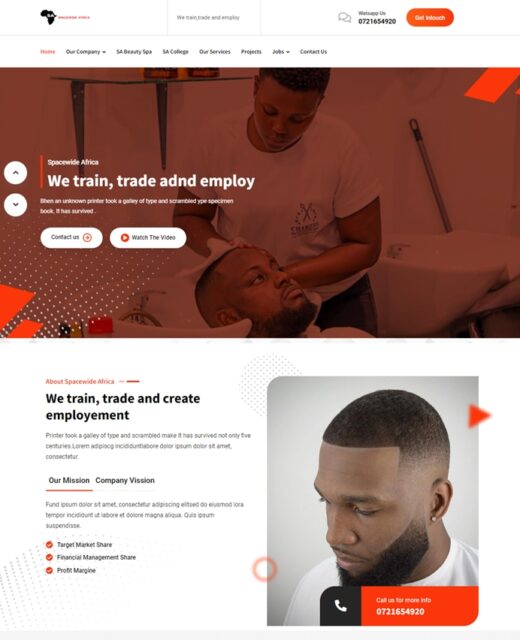

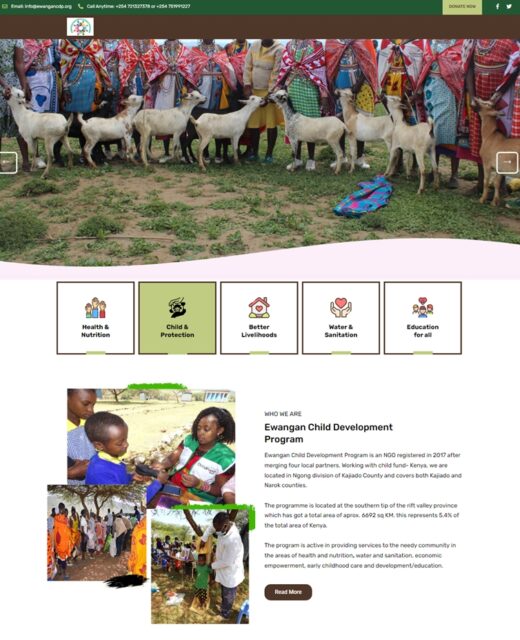

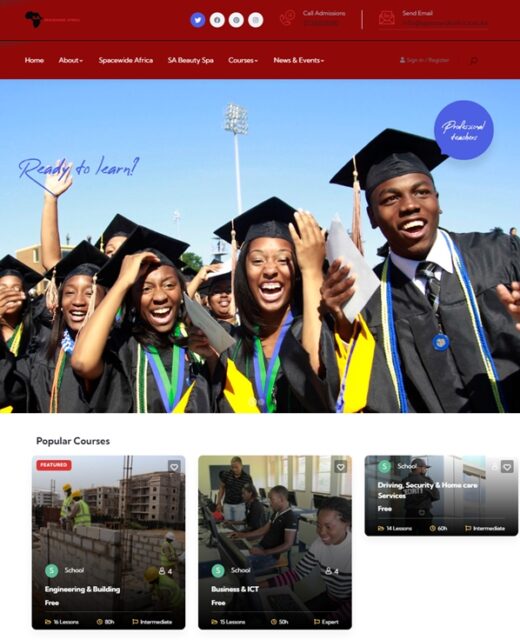

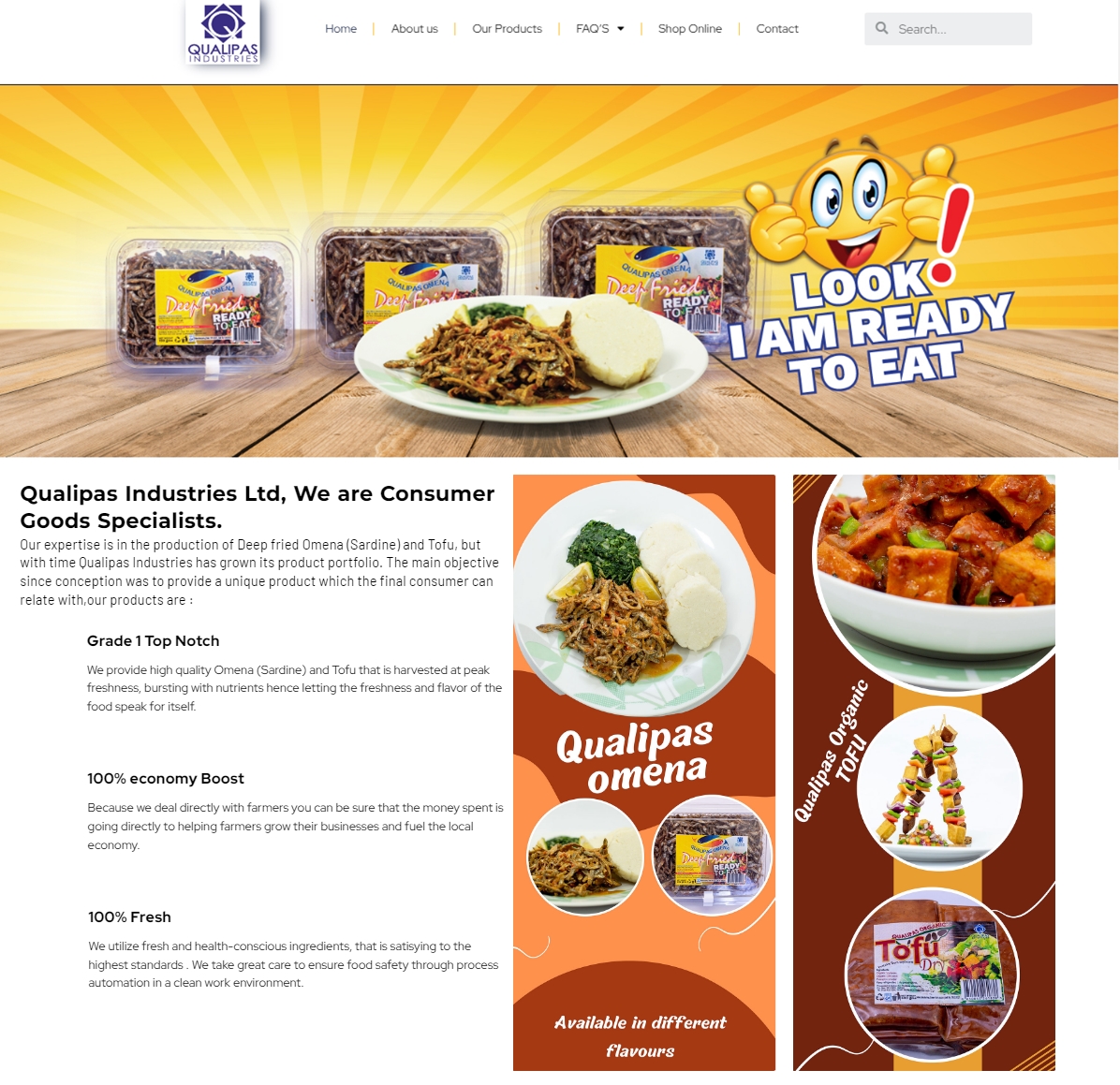

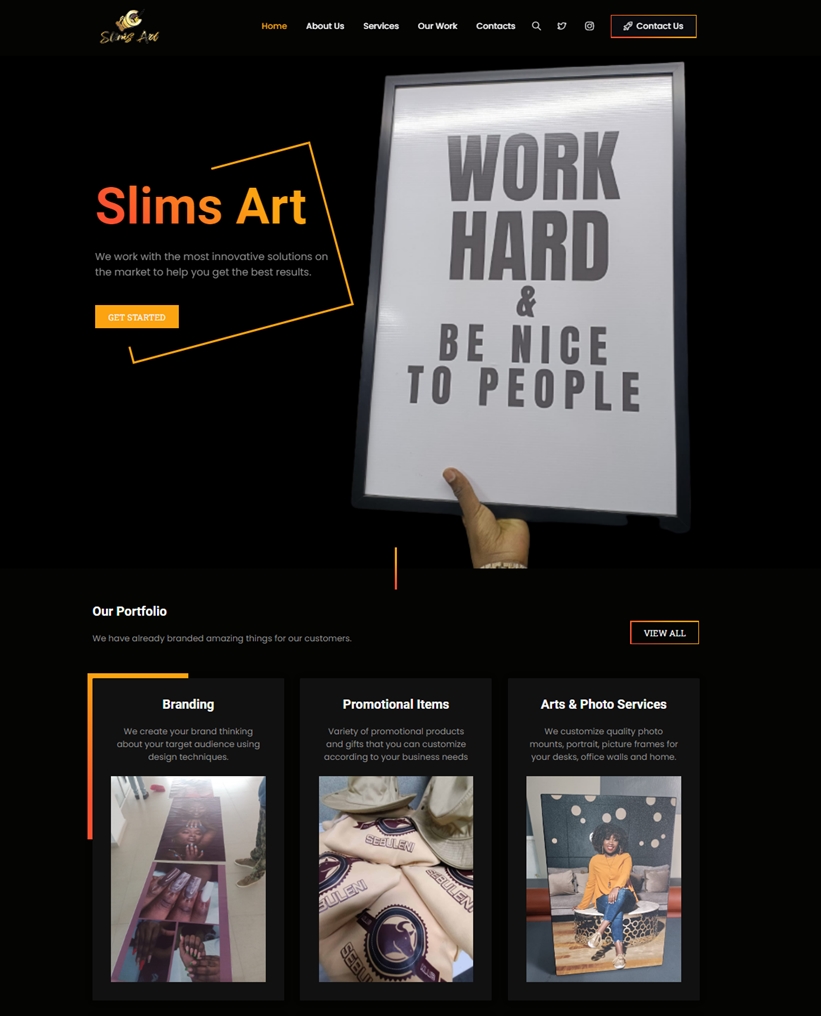

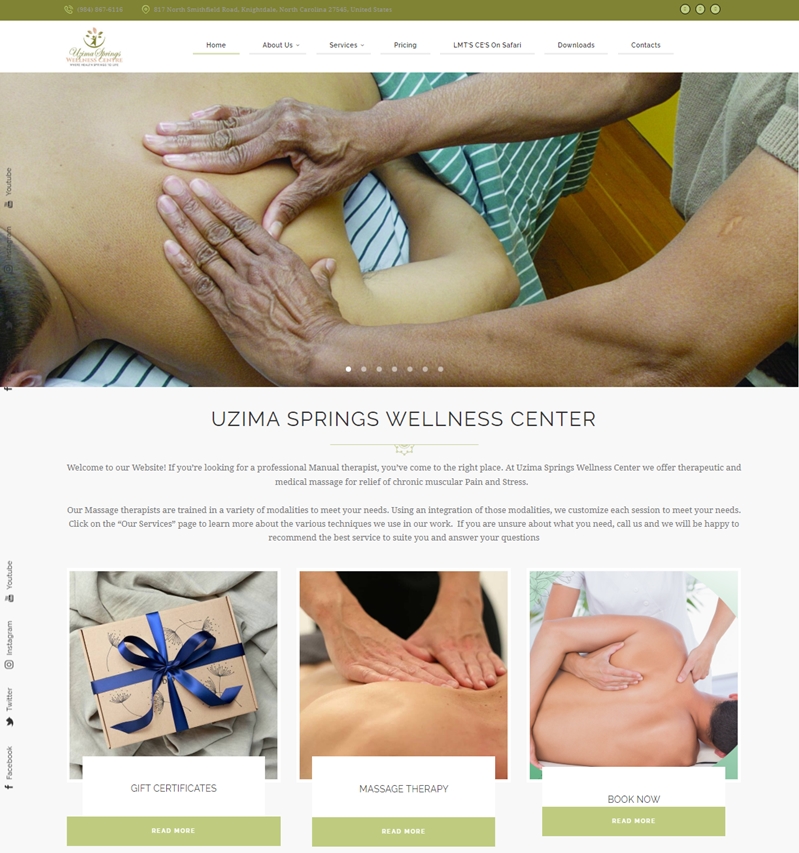

Website Design & Development

Investing in a great website can do magic for your company or organization. We help businesses elevate their value through custom web development.

SEO & Digital Marketing

With a well-optimized website,custom software or mobile app, you’ll make it easy for your customers to find you online, buy products, download resources or request your services.

Build Audience and Grow your online Brand.

Helycom Web Solutions is a full service digital agency specializing in Website design and development, mobile apps development, Software Development, Search engine optimization (SEO), USSD, SMS applications and Digital marketing.

As a team of professionals we focus on technology to combine our knowledge and expertise to create valuable online solutions and strategies, tailored to growing your business.

Discovery

Quisque placerat vitae lacus ut scelerisque. Fusce luctus odio ac nibh luctus, in porttitor theo lacus egestas.

Execute

Quisque placerat vitae lacus ut scelerisque. Fusce luctus odio ac nibh luctus, in porttitor theo lacus egestas.

Planning

Quisque placerat vitae lacus ut scelerisque. Fusce luctus odio ac nibh luctus, in porttitor theo lacus egestas.

Deliver

Quisque placerat vitae lacus ut scelerisque. Fusce luctus odio ac nibh luctus, in porttitor theo lacus egestas.

We Create Result-Oriented Dynamic Applications

Over 25 years working in IT services developing software applications and mobile apps for clients all over the world.

First Growing Process

At vero eos et accusamus etiusto odio praesentium.

Clean code

At vero eos et accusamus etiusto odio praesentium.

Well Documentation

At vero eos et accusamus etiusto odio praesentium.

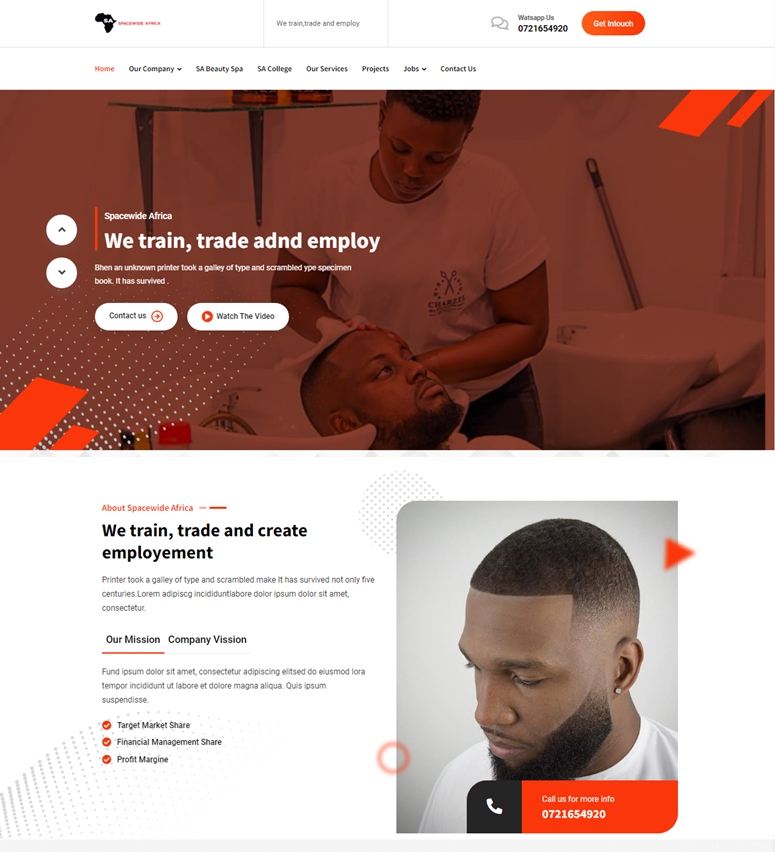

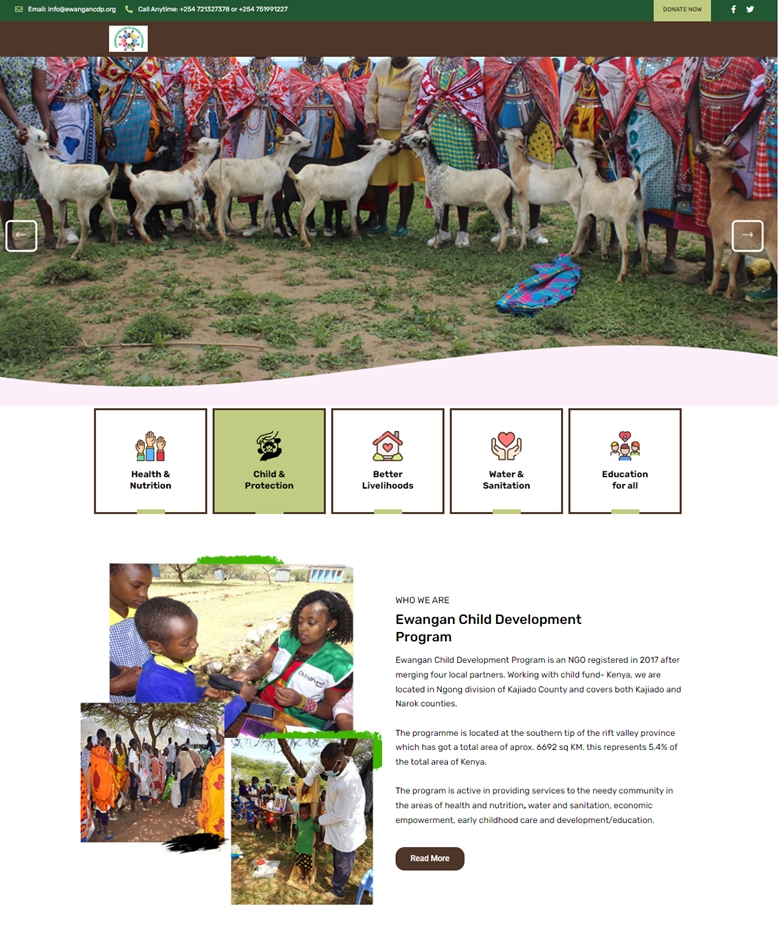

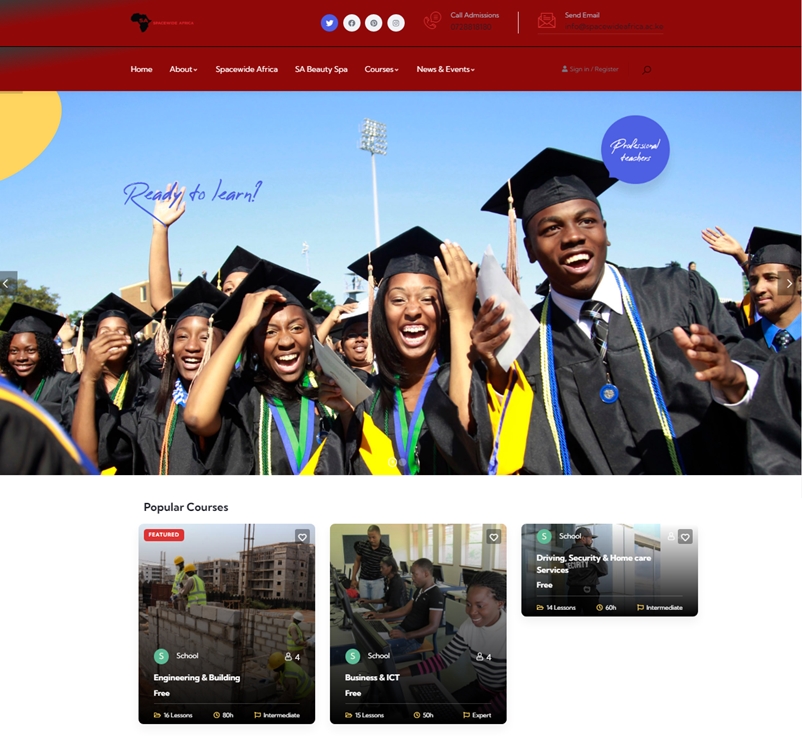

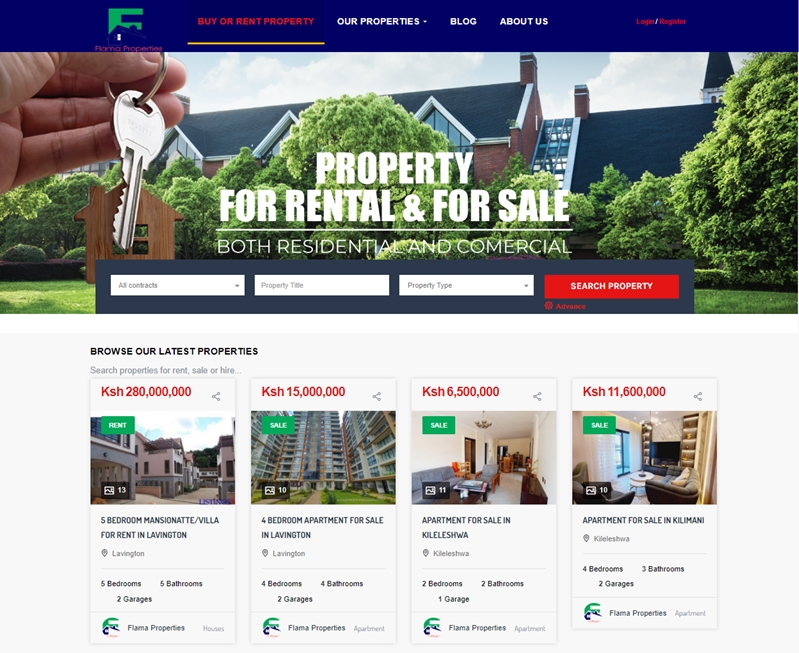

Our Recent Launched Projects Available into Market

Latest Tips &Tricks

We've been building creative tools together for over a decade and have a deep appreciation for software applications

What Customer Saying

Over 25 years working in IT services developing software applications and mobile apps for clients all over the world.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.

What Customer Saying

Over 25 years working in IT services developing software applications and mobile apps for clients all over the world.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.

Capitalize on low hanging fruit to identify a ballpark value added activity to beta test. Override the digital divide with additional clickthroughs from DevOps. Nanotechnology immersion along the information highway.